34+ what of income should mortgage be

Apply Online Get Pre-Approved Today. Web As mentioned above the rule of thumb is that you can typically afford a mortgage two to 25 times your yearly wage.

What Percentage Of Your Income Should Go To Mortgage Chase

Thats a mortgage between 120000 and.

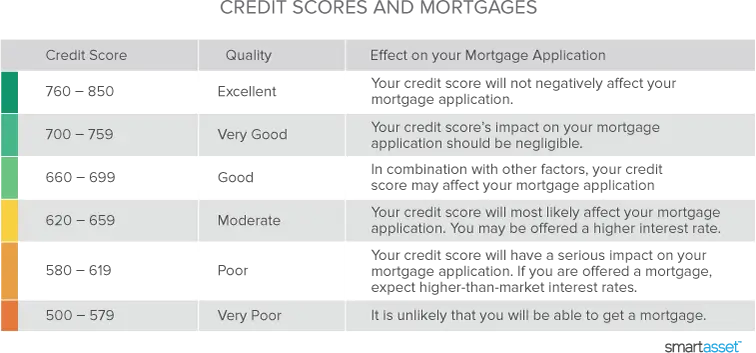

. And they see a 28 DTI as an excellent one. Companies are required by law to send W-2 forms to. Keep your mortgage payment at 28 of your gross monthly income or lower.

Ad Compare Home Financing Options Online Get Quotes. Ideally that means your monthly mortgage. Get Your Home Loan Quote With Americas 1 Online Lender.

Web Having a monthly budget helps you understand your financial capabilities. Web Some experts have suggested something called the 2836 rule. Highest Satisfaction for Mortgage Origination.

In NY First time buyer here. Web Back-end DTI includes all of your debt payments in addition to the proposed mortgage payment. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

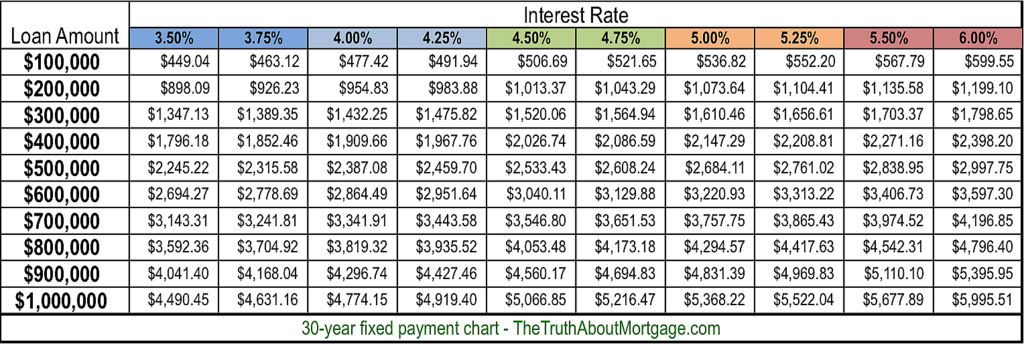

Multiply that by 28 percent 4167 x 028 and you get 1166 which is your maximum. Web This means your monthly payments should be no more than 31 of your pre-tax income and your monthly debts should be less than 43 of your pre-tax income. Web -3489 -181 Crude Oil.

Apply Online To Enjoy A Service. Web Generally speaking most prospective homeowners can afford to finance a property whose mortgage is between two and two-and-a-half times their annual gross. Ad Calculate Your Payment with 0 Down.

Where should I get mortgage. Web Following Kaplans 25 percent rule a more reasonable housing budget would be 1400 per month. Bank or broker or retail lender.

Track your monthly spending to see what percent of income you spend on each of the budget. Some financial experts recommend other percentage models like the 3545 model. Get All The Info You Need To Choose a Mortgage Loan.

Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web Lenders use your debt-to-income ratio DTI as a measure of affordability. Ad See how much house you can afford.

Ad Compare Best Mortgage Lenders 2023. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. The 28 rule isnt universal.

Web Q Im interested to know what the recommendations are regarding what proportion of our net monthly income should be going on mortgage payments. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web 1 day agoLets say you make 50000 a year which equates to about 4167 monthly.

Web 1 day agoImportant tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best. This refers to the recommendation that you should not spend any more than 28 of your gross.

Ad Compare Home Financing Options Online Get Quotes. Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more. Web The 3545 Model.

So taking into account homeowners insurance and property taxes. Get Your Home Loan Quote With Americas 1 Online Lender. This rule says you.

This is because of a large gap between the best. Estimate your monthly mortgage payment. Save Real Money Today.

Web Once a potential home buyer has taken the time to examine their personal finances and established how much house they can afford by using the 2836 ratio. Lenders want to make sure these expenses dont exceed 36 of your monthly. Web The Manufactured Home Loan Insurance program limits those with credit scores lower than 500 to a 90 loan-to-value ratio.

Keep your total monthly debts including your mortgage. Web 7 hours agoPensioners face being 20000 worse off in retirement by overlooking a key detail of their income arrangements. In other words these applicants.

Web The Bottom Line. Web Bank or broker or retail lender. No more than 25 percent of your income should be spent on mortgage principal and interest payments.

Choose The Loan That Suits You. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income or.

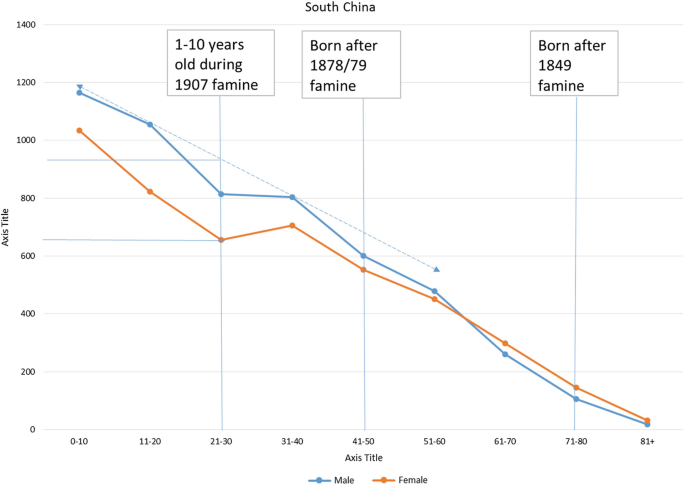

The China International Famine Relief Commission Springerlink

Rent A Room What To Know About Renting A Room In A House

Mortgage Preapproval Vs Prequalification How To Get Preapproved

How To Find Out If You Can Afford Your Dream Home

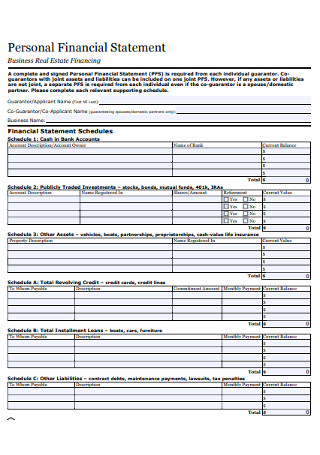

34 Sample Personal Financial Statement Templates Forms In Pdf Ms Word Excel

Terry Alm For All Things Related To Saskatoon Real Estate

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

How Much Home Can You Afford Www Hudhomenetwork Com

How Much Of My Income Should Go Towards A Mortgage Payment

C In2dg E668sm

15 Scattertree Ln Orchard Park Ny 14127 Zillow

Affordability Calculator How Much House Can I Afford Zillow

Home Loan And Financial Services Specialists In Annandale And Sydney S Inner West Mortgage Choice

34 Sample Personal Financial Statement Templates Forms In Pdf Ms Word Excel

How Much House Can You Afford Readynest

Free 34 Verification Forms In Pdf Excel Ms Word

Loan Sun Pacific Mortgage Real Estate Hard Money Loans In California